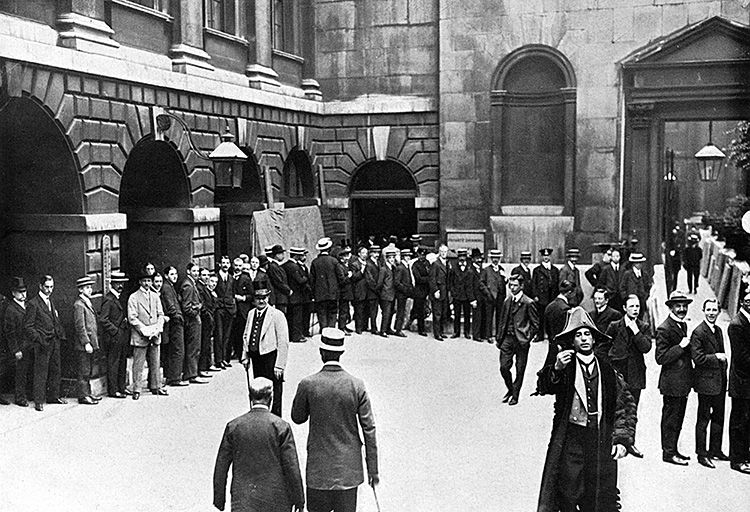

Banks to the Rescue

The opening battle of the First World War was won by the Bank of England before the British had so much as fired a shot.

Despite a minor crisis in 1907, Britain’s banks were riding high in summer 1914. The market was buoyant and interest was flowing into London from loans granted in almost every country of the world. The financial services sector was booming, interest rates stood at three per cent and, as in 2008, nobody foresaw the disastrous collapse that lay just around the corner.

Despite a minor crisis in 1907, Britain’s banks were riding high in summer 1914. The market was buoyant and interest was flowing into London from loans granted in almost every country of the world. The financial services sector was booming, interest rates stood at three per cent and, as in 2008, nobody foresaw the disastrous collapse that lay just around the corner.