Advice to the Teens

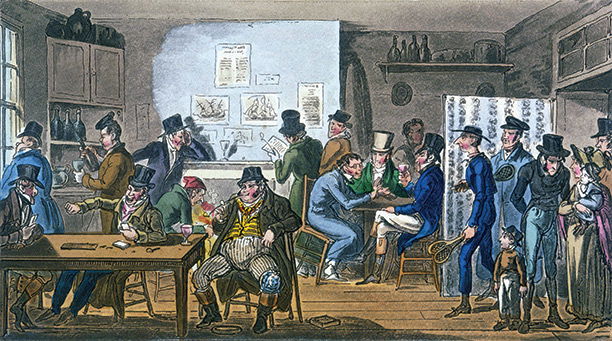

Loan sharks, youth debt, peer pressure and parental responsibility are not just issues of the moment. Nicola Phillips tells the story of a young Regency buck who pushed his father a financial step too far.

As we grapple with economic crises and easy credit, government overspending and a generation of parents whose expenditure threatens to saddle their children with crippling debts, concerns about profligacy and indebtedness have grown. The Citizens’ Advice Bureau lists debt as a major issue facing young people under 25, most of which relates to personal loans, overuse of store cards and bank overdrafts. Buying goods on credit rather than with cash is commonplace and students face unprecedented levels of debt from the moment they start university. In the early 19th century, when the use of credit was equally ubiquitous, questions about the acquisition and responsibility for debt were remarkably similar to those faced by families today. Who is most at fault?

As we grapple with economic crises and easy credit, government overspending and a generation of parents whose expenditure threatens to saddle their children with crippling debts, concerns about profligacy and indebtedness have grown. The Citizens’ Advice Bureau lists debt as a major issue facing young people under 25, most of which relates to personal loans, overuse of store cards and bank overdrafts. Buying goods on credit rather than with cash is commonplace and students face unprecedented levels of debt from the moment they start university. In the early 19th century, when the use of credit was equally ubiquitous, questions about the acquisition and responsibility for debt were remarkably similar to those faced by families today. Who is most at fault?